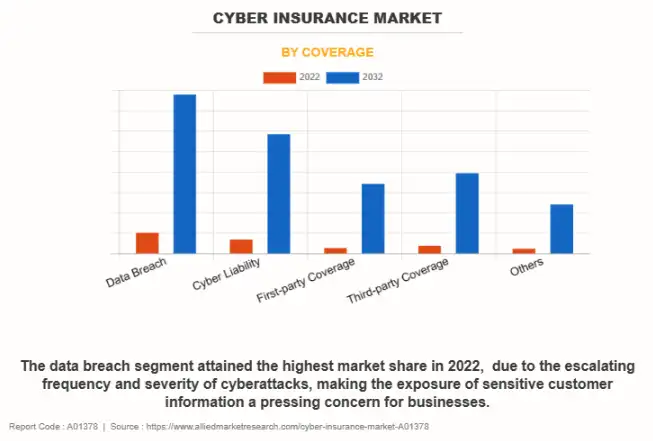

Data breaches can be terrifying for any business. They result in significant financial losses, tarnished reputations, and legal nightmares. As cyber-attacks grow more sophisticated, the threat of a breach looms larger than ever. In fact, research proves that 2023 saw a 72% increase in data breaches since 2021, which held the previous all-time record.

This is where data breach insurance becomes essential. This specialized insurance helps businesses manage the financial fallout from a data breach, ensuring they can recover swiftly and minimize damage.

As Brian Leger, Co-Founder of InfoTECH Solutions, says, “Data breach insurance is the lifeboat that keeps your business afloat amidst the storm of cyber threats.”

In this blog, we will delve into what data breach insurance covers and its importance for businesses. Understanding these aspects will help you make informed decisions to protect your business from the devastating impacts of a data breach.

Concerned About Data Loss and Security Breaches?

InfoTECH Solutions offers tailored solutions for comprehensive data protection.

Learn MoreUnderstanding Data Breach Insurance

Data breach insurance is a specialized type designed to help businesses mitigate the financial risks of data breaches.

The costs of managing a data breach can be overwhelming, from notifying affected parties to covering legal fees and regulatory fines. Data breach insurance offers a vital safety net, helping businesses navigate these challenges by covering the expenses related to security breaches.

This insurance ensures businesses can recover quickly and continue their operations with minimal disruption.

Source: AM Trust Financial

What Does Data Breach Insurance Cover?

Data breach insurance typically covers several key areas to protect your business comprehensively:

1. Notification Costs

Notifying affected parties when a data breach occurs is both a legal requirement and a critical step in mitigating damage. Data breach insurance covers the costs of notifying customers, employees, and other stakeholders about the breach.

This can include communication expenses, setting up a call center, and providing credit monitoring services to affected individuals.

2. Legal Fees and Expenses

A data breach often leads to legal challenges. Businesses may face lawsuits from affected parties or regulatory bodies. Data breach insurance covers the legal fees and expenses of defending against these claims. This includes court costs, attorney fees, and settlements or judgments awarded by the court.

3. Regulatory Fines and Penalties

Businesses are subject to various data protection regulations, such as GDPR or CCPA. Non-compliance or failure to protect sensitive data can result in fines and penalties. Data breach insurance helps cover these regulatory fines, ensuring your business can manage the financial impact of compliance issues.

4. Business Interruption

A data breach can disrupt your business operations, leading to significant financial losses. Data breach insurance covers business interruption, compensating for lost income and additional expenses incurred while your business recovers. This ensures that your business can continue to operate and meet its financial obligations even during a crisis.

5. Cyber Extortion

Cybercriminals often demand ransom payments for not disclosing stolen data or restoring access to encrypted systems.

Data breach insurance covers the costs associated with cyber extortion, including ransom payments and the expenses involved in negotiating with cybercriminals.

6. Crisis Management

Managing the aftermath of a data breach requires a coordinated effort. Data breach insurance includes coverage for crisis management services, such as public relations and media management, to help protect your business’s reputation. This can involve hiring PR firms, conducting media campaigns, and managing customer communications.

7. Credit Monitoring Services

Data breach insurance often covers the costs of providing credit monitoring services to mitigate the impact on affected individuals. These services help detect fraudulent activity and protect the credit status of those whose personal information was compromised in the breach.

8. Third-Party Coverage

In addition to covering your own business, data breach insurance provides third-party coverage. This protects your business from claims made by customers, partners, or other third parties affected by the breach. It covers legal fees, settlements, and other costs associated with third-party claims.

9. Data Restoration and Recovery

Restoring and recovering compromised data can be costly and time-consuming. Data breach insurance covers the expenses related to data restoration and recovery, ensuring that your business can regain access to critical information and resume normal operations.

10. Employee Training and Awareness

95% of cybersecurity breaches are due to human error. Preventing future breaches is just as important as managing the fallout from a current one. Data breach insurance often includes coverage for employee training and awareness programs. These programs educate employees on best practices for data security and help prevent future breaches.

The Importance of Data Breach Insurance for Small Businesses

Small businesses are particularly vulnerable to data breaches due to limited resources and cybersecurity expertise. Data breach insurance provides essential protection for small businesses, helping them manage the financial and operational impacts of a breach. By investing in this insurance, small businesses can safeguard their future and ensure they can recover swiftly from security breaches.

How to Choose the Right Data Breach Insurance

When selecting data breach insurance, consider the following factors to ensure you choose the right coverage for your business:

- Assess Your Risks: Evaluate your business’s specific risks and choose a policy that addresses those risks. Consider the type of data you handle, the size of your business, and your industry-specific regulations.

- Coverage Limits: Ensure the policy provides adequate coverage limits to protect your business. Consider the potential data breach costs, including legal fees, notification costs, and business interruption expenses.

- Exclusions and Limitations: Review the policy for any exclusions or limitations that may affect your coverage. Understand what is and isn’t covered to avoid surprises in the event of a breach.

- Additional Services: Look for policies that offer additional services, such as employee training, risk assessments, and incident response planning. These services can help prevent breaches and minimize their impact.

- Reputation of the Insurer: Choose a reputable insurer with experience in providing data breach insurance. Check reviews and ratings to ensure they have a track record of handling claims effectively.

Comparison of Data Breach Insurance and General Liability Insurance

| Feature | Data Breach Insurance | General Liability Insurance |

| Coverage Focus | Cybersecurity incidents and data breaches | Bodily injury, property damage, and personal injury claims |

| Typical Incidents Covered | Hacking, phishing attacks, ransomware, data theft | Slip and fall accidents, property damage, defamation |

| Legal Defense Costs | Covers legal fees related to data breaches | Covers legal fees related to general liability claims |

| Business Interruption | Covers loss of income due to cyber incidents | Does not typically cover business interruption |

| Regulatory Fines | Covers fines from data protection regulations | Does not cover regulatory fines |

| Notification Costs | Covers costs of notifying affected parties | Does not cover notification costs |

| Third-Party Claims | Covers claims from customers or partners due to data breach | Covers claims from third parties for bodily injury or property damage |

| Crisis Management | Includes PR and communication services | Does not typically include crisis management services |

| Credit Monitoring | Provides credit monitoring services to affected individuals | Does not cover credit monitoring services |

Strengthen Your Cyber Defenses with InfoTECH Solutions

Investing in data breach insurance is a crucial step in protecting your business from cyber threats’ financial and reputational damages.

| Discover Trusted Cybersecurity Services in New Orleans, LA |

While insurance provides essential coverage, partnering with a trusted Managed IT Services Provider like InfoTECH Solutions can further safeguard your business.

At InfoTECH Solutions, we specialize in comprehensive cybersecurity strategies tailored to your needs. Our expert team will implement robust security measures, conduct regular risk assessments, and protect your business.

Don’t leave your business vulnerable! Contact us today to schedule a free consultation and discover how we can enhance your cybersecurity defenses.

Secure your future with InfoTECH Solutions.