Cyber attacks are not just a theoretical risk anymore; they’re a costly reality. A recent report by Cybersecurity Ventures predicts that cybercrime will cost the world $8 trillion annually in 2023 and $10.5 trillion by 2025.

In today’s precarious landscape, “ignoring cyber insurance is no longer an option for businesses because digital threats are a daily reality,” says Brian Leger, co-founder of InfoTECH Solutions.

As you grapple with the complexities of cyber insurance, understanding its cost is crucial. In this article, we’ll take a closer look at cyber insurance costs to help you determine the right policy and level of coverage for your business.

How Much Does Cyber Liability Insurance Cost?

Find out with expert guidance and support from our security experts.

Learn MoreWhat Exactly is Cyber Insurance?

Cyber insurance is designed to mitigate the financial risks associated with digital threats. It typically covers expenses related to data breaches, cyber-attacks, and business interruption.

With the average cost of a security incident reaching $4.45 million, having a cyber insurance policy in place is critical for businesses of all sizes.

As a business owner, it’s essential to understand what cyber insurance entails and how it can protect your enterprise.

Who Needs Cyber Liability Insurance?

Every Business in the Digital Age

Virtually every business that uses technology to store or process data needs cyber liability insurance. Whether you operate a small retail store or a large corporation, if you store sensitive data, you are at risk.

Industries at Higher Risk

Businesses in the healthcare, finance, and retail industries handle large amounts of sensitive customer data and are at a particularly high risk of cyber-attacks and data breaches.

The healthcare industry, in particular, has been a common target for attackers, with a total of 365,966,815 medical records exposed between 2019 and 2022.

Businesses That Use Online Transactions

Research shows that more than 91% of e-commerce businesses reported at least one major security incident last year.

As a result, companies engaging in e-commerce or online transactions should prioritize cyber insurance to protect against potential financial losses and legal costs associated with cyber incidents.

Key Factors That Influence Cyber Insurance Costs

1. Size and Type of Your Business

The size of your business plays a significant role in determining your cyber insurance costs. Larger businesses with complex structures often face higher cyber insurance premiums due to the increased risk and potential impact of a cyber incident.

2. Your Industry’s Risk Profile

As previously mentioned, some industries are more vulnerable to cyber threats, leading to higher premiums. Additionally, businesses in regulated sectors may need to comply with specific regulations, influencing their cybersecurity insurance costs.

Interested in learning more about cybersecurity? Check out these blogs:

3. Claims History and Security Posture

A history of frequent claims can increase your premiums. Conversely, implementing robust security measures can demonstrate to an insurance company your commitment to reducing risk, potentially lowering costs.

4. Specific Coverage Needs

The specifics of your cyber liability coverage, such as party coverage, business interruption, and data breach insurance, will affect the overall cost. Tailoring your coverage to your business’s specific needs can be more cost-effective.

5. Coverage Limits and Geographic Location

Businesses in regions with higher rates of cybercrime or stringent data protection laws may face increased cyber liability insurance costs.

6. Regulatory Environment

Businesses operating in heavily regulated industries may incur additional costs due to compliance with regulatory fines and legal costs. The cost of non-compliance is steep, and could set you back more than $14 million.

Understanding the Average Costs and Trends

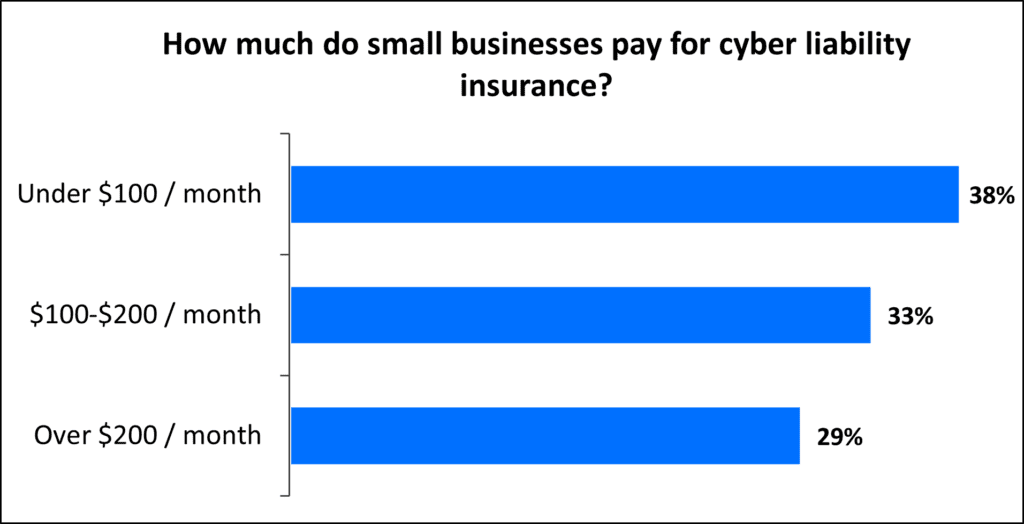

The answer to the question “How much does cyber insurance cost?” varies significantly. For small businesses, premiums can cost around $145 per month or $1,740 annually, depending on coverage scope and risk factors.

However, as previously stated, costs can vary significantly, to the extent that 38% of small businesses pay less than $100 per month for their premium. Larger businesses can expect higher premiums, often exceeding tens of thousands of dollars.

Source: TechInsurance

Balancing Costs With Adequate Coverage

Finding the right balance between cost and coverage is crucial. That’s why you should:

- Conduct thorough risk assessments

- Implement effective security measures

- Regularly update your policies to address evolving cyber threats

Predicting the Future of Cyber Insurance Costs

With the increasing frequency and severity of cyber incidents, it is likely that cyber insurance premiums will continue to rise.

In fact, in 2022 alone, cyber insurance rates doubled in the first quarter and increased by 79% in Q2. That’s why staying informed and proactive is key to managing future costs effectively.

Learn More About Cyber Insurance Costs From a Trusted Partner

Understanding and managing cyber insurance costs is crucial for today’s businesses, as is finding the best policy for your unique needs. If you need help finding cyber insurance coverage, we can help.

Navigate Your Cybersecurity Issues With InfoTECH Solutions:

InfoTECH Solutions’ cybersecurity experts utilize their experience to guide you in choosing the right policy while implementing effective security strategies that keep your business and its sensitive data out of the crosshairs.

Start your journey to cyber insurance coverage on the right foot by contacting us today to schedule a free consultation.